Are you tired of using your hard-earned after-tax dollars to cover medical expenses? As a business owner, the burden of managing healthcare costs can be overwhelming. However, there’s a little-known solution that can alleviate this financial strain – the Health Spending Account.

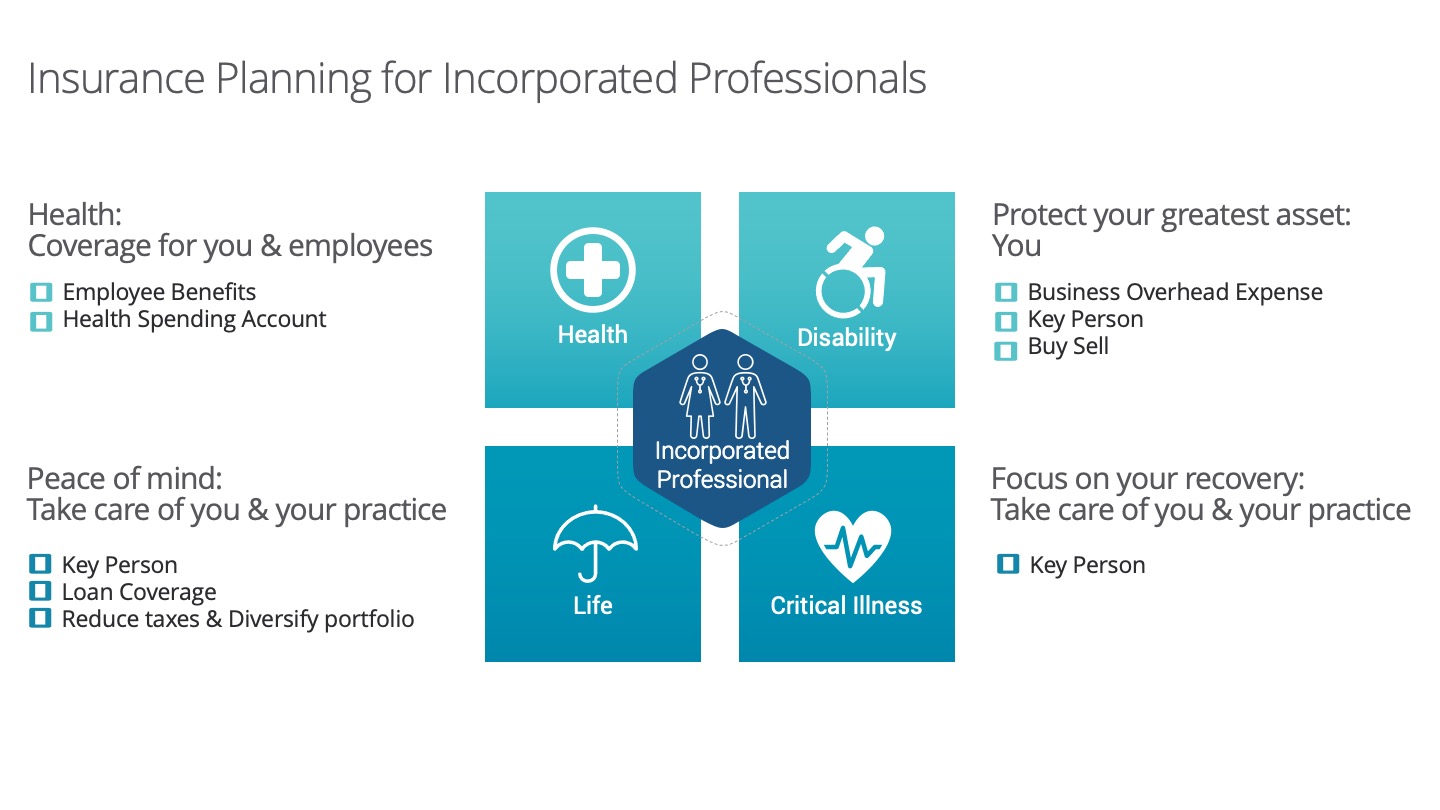

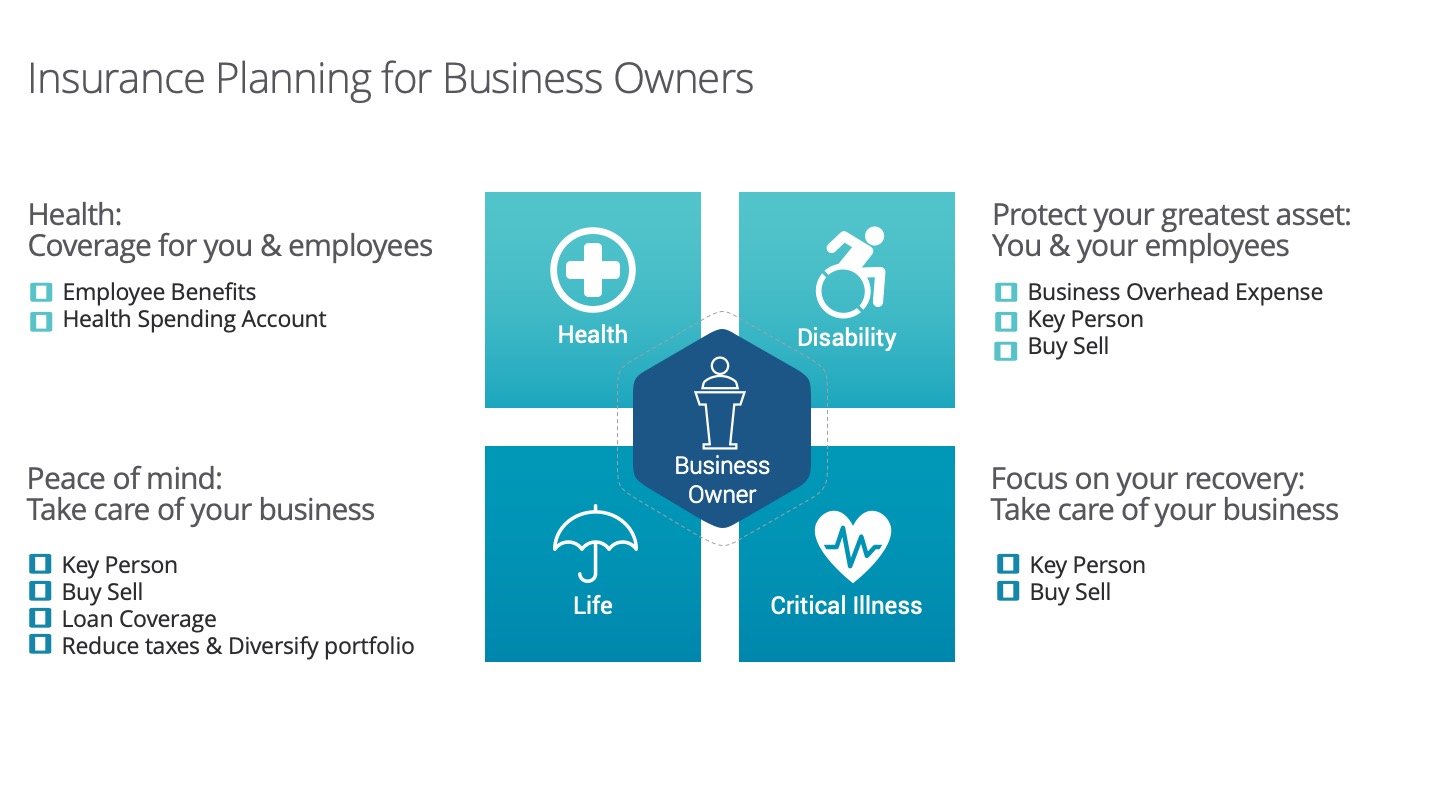

Designed specifically for entrepreneurs like you, the Health Spending Account offers a tax-efficient way to manage medical expenses. Say goodbye to paying out of pocket with after-tax dollars for your healthcare needs, and let’s explore the advantages of this specialized account tailored to meet the unique needs of business owners and incorporated professionals.

Who’s eligible?

The Health Spending Account is available to a wide range of businesses, making it an inclusive and flexible solution. Small businesses, professional corporations, and corporations that wish to supplement an existing health plan are all eligible to participate in this program. Whether you run a small family-owned enterprise, a professional practice, or a larger corporate entity, the Health Spending Account can cater to your specific needs and provide valuable healthcare benefits for you and your employees.

What are the benefits?

Tax Deductibility for Corporations

As a business owner or incorporated professional, you know the significance of minimizing tax burdens. The Health Spending Account allows your corporation to make contributions that are 100 percent tax-deductible. By taking advantage of this tax benefit, you can reduce your corporation’s taxable income, resulting in lower overall taxes. This leaves you with more funds to reinvest in your business, expand operations, or reward your hardworking employees.

Tax-Free Benefits for You and Your Employees

The Health Spending Account offers tax-free reimbursements for both you, as the business owner or incorporated professional, and your employees. Any medical expense covered through the account is received as tax-free income. This means you get to retain more of your earnings while providing valuable healthcare benefits to your workforce without increasing their taxable income. It’s a win-win situation that fosters employee satisfaction and loyalty.

No monthly premium to pay and cost-efficient

A Health Spending Account (HSA) offers a highly cost-efficient approach to managing medical expenses, providing individuals and businesses with significant financial advantages. One of the key benefits of an HSA is that there is no monthly premium to pay, unlike traditional health insurance plans. This means that participants can access valuable healthcare benefits without the burden of regular premium payments. With no ongoing costs, the HSA allows individuals and businesses to allocate their funds more strategically, ensuring that their healthcare budget is utilized efficiently. This cost-effective feature makes the Health Spending Account an attractive option for those seeking to optimize their healthcare spending while enjoying comprehensive medical coverage.

How it works

The Health Spending Account simplifies the process of managing healthcare expenses:

1. Employees pay for medical services out of pocket.

2. The employee submits the claim for reimbursement.

3. The claim amount is then reimbursed tax-free through the corporation’s account.

4. The claim is reimbursed to the employee.

This streamlined process eliminates the complexities associated with traditional health insurance plans, saving you time and effort.

To learn more about how a health spending account can benefit you, please reach out today to book a meeting, and we would be happy to help.