The Key Differences Between a Defined Benefit and Defined Contribution Pension Plan

The Key Differences Between a Defined Benefit and Defined Contribution Pension Plan

As an employer, you may be thinking about offering your employees a pension plan. If so, you have two main options:

-

Defined benefit pension plan

-

Defined contribution pension plan

A defined benefit pension plan offers your employees a set amount of money when they retire, whereas a defined contribution pension plan, does not.

There are four key areas you should be aware of when selecting a pension plan:

-

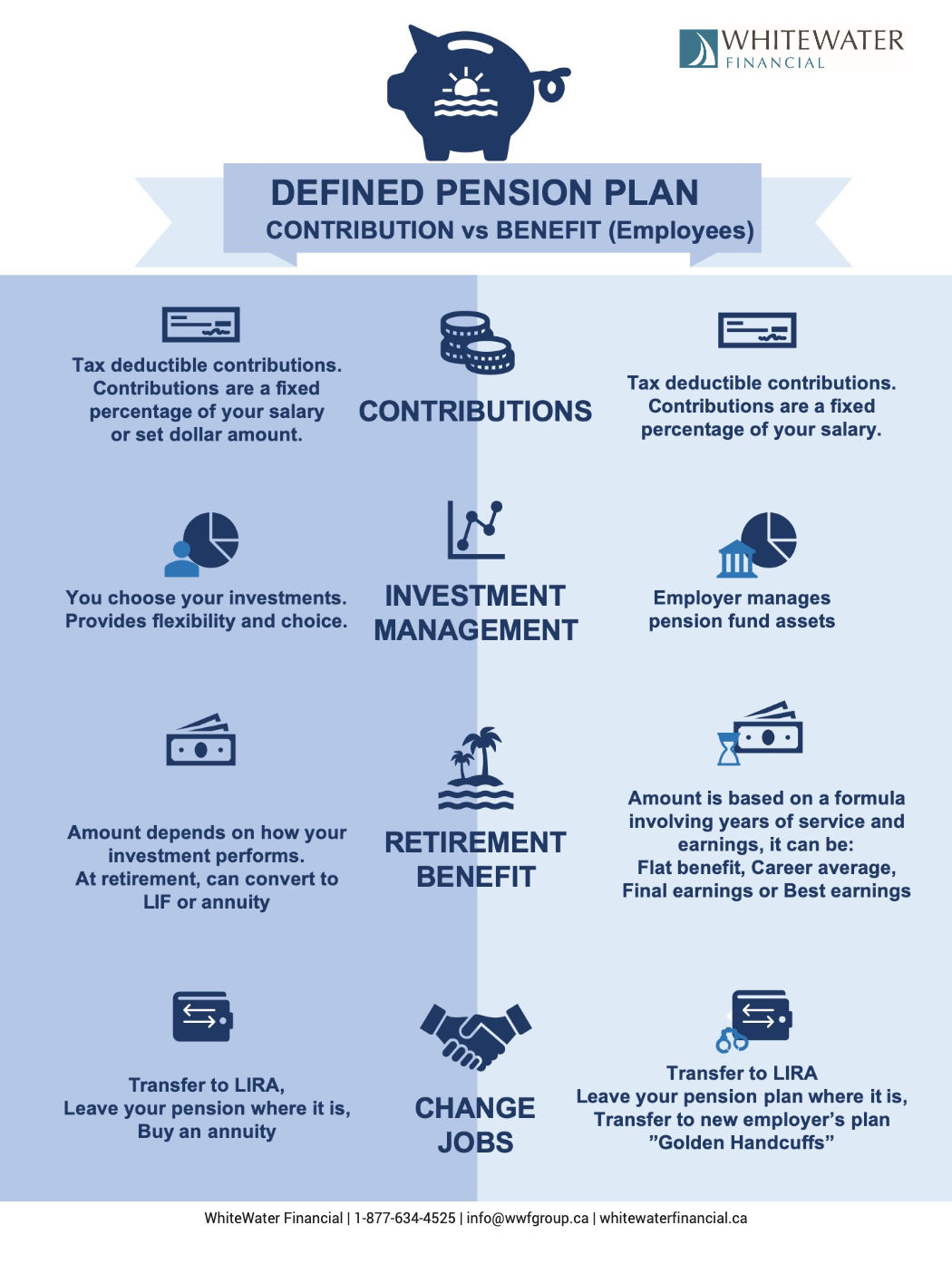

Contributions

-

Investment Management

-

Costs

-

Employee Retention

We will compare each of the areas to give you a better understanding of the differences between the two types of pension plans.

|

Defined benefit pension plan |

Defined contribution pension plan |

|

|

Contributions |

Both the employer and the employee will contribute to the pension plan. The amount that you contribute each year will depend on what kind of expenses the pension plan has, and the amount of funding it will require that year. |

Employees contribute a set amount each year into their pension. As an employer, you can choose to match or “top up” the employees’ contributions to a set amount that you define in advance. |

|

Investment Management |

As an employer, you or your pension plan administrator will be responsible for managing the funds. This is applicable whether the employee is actively contributing to the fund or has retired and is receiving funds from it. |

You can let your employees choose how they want to invest their funds. This provides employees with more flexibility and choice and takes the responsibility off you, as the employer, to manage pension funds. However, you will still need to have a range of funds for your employees to select from. |

|

Costs |

An actuary will work with you (approximately every three years) to calculate how much money you will need to cover the pension expenses. The actuary must consider everything from cost of living adjustments to how many employees will be retiring. |

The costs will be lower as less active management is required. Employees will receive whatever amount their investments are worth when they retire. |

|

Employee Retention |

Both types of pension plans will help attract and retain employees. Since a defined benefit plan builds in value each year, it is more likely to attract employees interested in staying with the company for a long time. |

A defined contribution plan will also attract employees, but the pension will be less appealing than a defined benefit plan. |

The Takeaway

A defined benefit plan will cost you more to set up, maintain, and administer, but it offers your employees more stability in their retirement. A defined contribution plan will give you and your employees more flexibility and cost you less to manage.

Either type of plan will help you attract and retain employees. For both types of plans, contributions are tax-deductible for the employee.

If you are considering offering a pension plan to your employees but don’t know where to start, please do not hesitate to contact us. We’re here to help.